Here's all you need to do:

Shop with HSA/FSA Funds for Tax-Free Health & Wellness Purchases

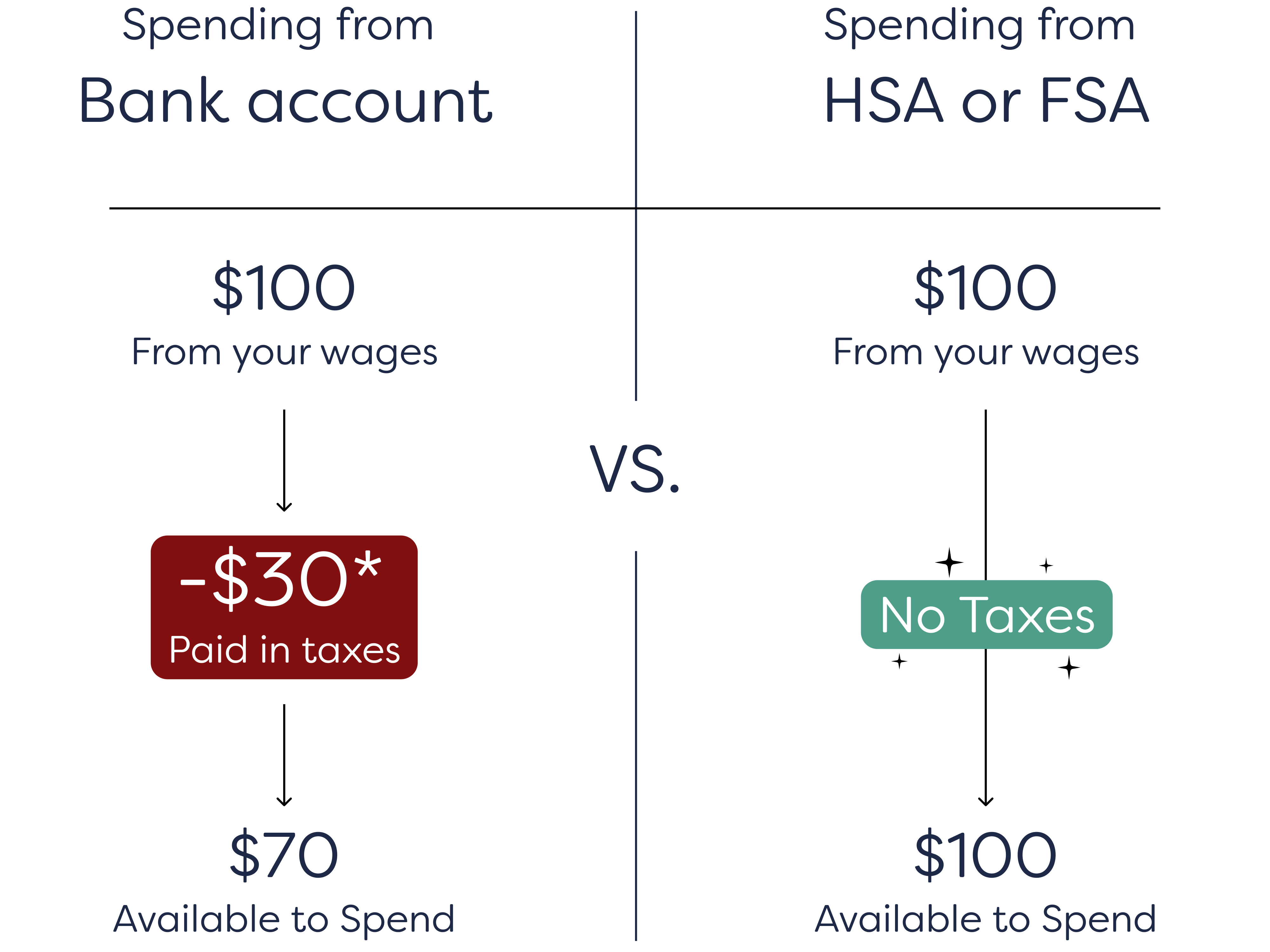

At Vimergy, we see our products as natural medicine. Thanks to our new partnership with Truemed, eligible customers can now use HSA or FSA funds to purchase Vimergy supplements. This means you can support your health with pre-tax dollars and save an average of 30%.

*On average, 30% of gross income is paid to state and federal tax. Individual tax rates vary.

Step #2: Visit the “For Shoppers” page of the Truemed website Here you will find a list of merchants who have completed our compliance evaluation.

Step #3: Follow the steps listed on the specific merchant’s page Once you find a merchant you intend to utilize, follow the specific steps listed on the merchant's page.